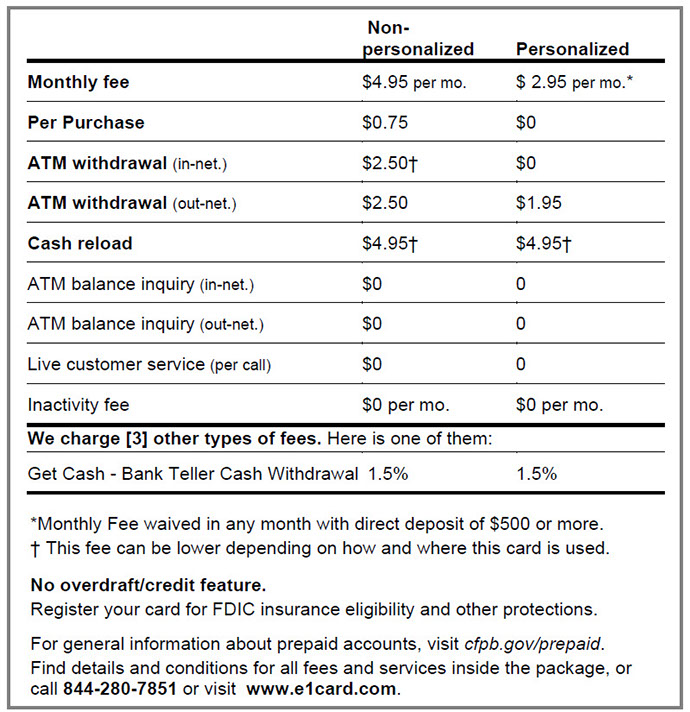

See our clear fees

E1 Prepaid Visa Card is issued by Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A Inc. Card is serviced by Pathward.

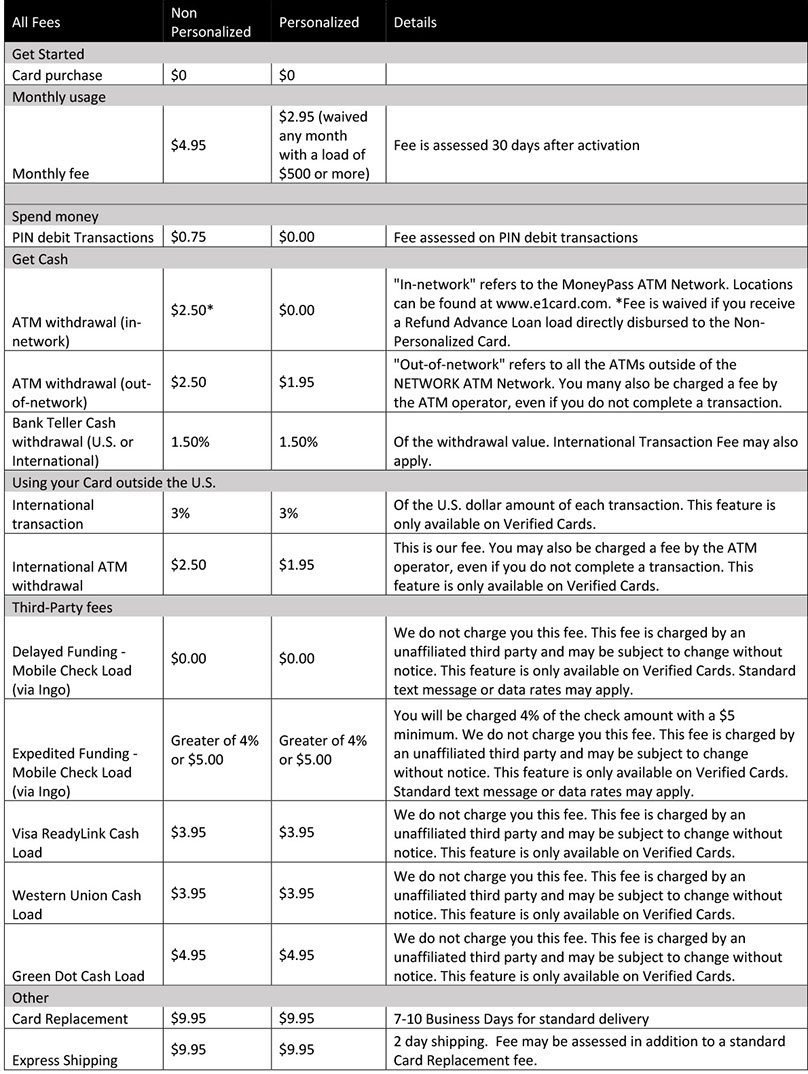

List of all fees ("Long Form") for E1 Visa Prepaid Card

Your funds are eligible for FDIC insurance. Your funds will be held at or transferred to Pathward, an FDIC-insured institution. Once there, your funds are insured up to $250,000 by the FDIC in the event Pathward fails, if specific deposit insurance requirements are met. See fdic.gov/deposit/deposits/prepaid.html for details.

No overdraft/credit feature.

Contact Customer service by calling 1-844-220-7851, by mail at 5501 S. Broadband Lane Sioux Falls, SD, 57108, or visit www.e1card.com.

For general information about prepaid accounts, visit cfpb.gov/prepaid. If you have a complaint about a prepaid account, call the Customer Financial Protection Bureau at 1-855-411-2372 or visit cfpb.gov/complaint.

ATM Fees: When you use an ATM, you may be charged a fee by the ATM owner or operator or any network used to complete the transaction. Please note that you may be charged a fee by an ATM owner or operator for a balance inquiry performed at ATM even if you do not complete a cash withdrawal. Read the ATM screen message carefully for information related to fees before you complete a transaction at an ATM. To avoid ATM fees, you may request cash back when making purchases at retailers, such as grocery stores, by selecting "DEBIT" any entering your PIN.

E1 Visa® Prepaid Card Cardholder Agreement

CUSTOMER SERVICE CONTACT INFORMATION:

Address: 5501 S. Broadband Lane Sioux Falls, SD, 57108

Website: www.e1card.com

Phone Number: 844-280-7851

IMPORTANT NOTICES:

PLEASE READ CAREFULLY. THIS AGREEMENT CONTAINS AN ARBITRATION PROVISION REQUIRING ALL CLAIMS TO BE RESOLVED BY WAY OF BINDING ARBITRATION.

ALWAYS KNOW THE EXACT DOLLAR AMOUNT AVAILABLE ON THE CARD. MERCHANTS MAY NOT HAVE ACCESS TO DETERMINE THE CARD BALANCE.

BY ACCEPTING, SIGNING, OR USING THIS CARD, YOU AGREE TO BE BOUND BY THE TERMS AND CONDITIONS CONTAINED IN THIS AGREEMENT.

IF YOU DO NOT AGREE TO THESE TERMS, DO NOT USE THE CARD. CANCEL THE CARD BY CALLING CUSTOMER SERVICE AND REQUESTING A REFUND CHECK, IF APPLICABLE.

BY USING THIS CARD, YOU ARE ALSO AGREEING TO PATHWARD’S PRIVACY POLICY (ATTACHED).

This Cardholder Agreement (“Agreement”) sets forth the terms and conditions under which the E1 Visa Prepaid Card (“Card”) has been issued to you by Pathward, National Association. In this Agreement, general references to “Card” include, unless otherwise specified, both Verified and Unverified Cards. “Verified Cards” are cards for which you have provided Pathward personally identifying information that has been verified through our customer identification process. Verified Cards include the Non-Personalized Card that you get at a retail location and arrange for a tax refund load (“Non-Personalized Card”), as well as the Personalized Card you may get by initiating a Qualified Load, as defined below. “Loyalty Cards” are cards that may be registered with limited personal information provided by you, but have not been run through our verification process. Your Loyalty Card may be pre-loaded with funds as incentive for visiting the retail location where you obtained the Card. As used in this Agreement and your Fee Schedule, “Qualified Load” means a non-tax refund load you initiate, such as cash, mobile check through a third party service provider, or ACH credit (direct deposit) load. "You" and "your" means the person or persons who have received and are authorized to use the Card as provided for in this Agreement. "We," "us," and "our" mean, Pathward, a federally-chartered savings bank, Member FDIC, and its divisions or assignees. The Card is nontransferable, and it may be canceled at any time without prior notice subject to applicable law. Please read this Agreement carefully and keep it for future reference. Your full fee schedule (“Fee Schedule”) is attached to and considered part of this Agreement.

ABOUT YOUR CARD

Your Card is a prepaid card, which allows you to access funds loaded to your Card account. You should treat your Card with the same care as you would treat cash. We encourage you to sign your Card when you receive it. This Card is intended for personal, family, or household use and not intended for business purposes. Your Card account does not constitute a checking or savings account and is not connected in any way to any other account you may have. The Card is not a gift card, nor is it intended to be used for gifting purposes. The Card is not a credit card. You will not receive any interest on the funds in your Card account. We may close your Card or refuse to process any transaction that we believe may violate the terms of this Agreement or represents illegal or fraudulent activity. You are responsible for notifying us immediately upon any change to your address, phone number, or email address. If your address changes to a non-US address, we may cancel your Card and return funds to you in accordance with this Agreement.

YOUR CARD FUNCTIONALITY

Unverified Cards

You are not required to verify your Card through the verification process explained below. If you choose not to do so, you will be limited in functionality and protections, as indicated throughout this Agreement. You will not be able to load funds, enroll in direct deposit, or conduct international transactions to your unverified Loyalty Card. If you would like to enable these additional functionalities, or ensure your Card is protected by FDIC insurance, you must go through the verification process below. Card verification takes place at the retail location where you received the Card.

Verified Cards

Important information for verifying a Card: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires all financial institutions and their third parties to obtain, verify, and record information that identifies each person who opens a Verified Card.

What this means for you: When you open a Verified Card account, we will ask for your name, street address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identification documents at any time. We may limit your ability to use your Card or certain Card features until we successfully verify your identity.

Eligibility and Activation: To be eligible to use and activate a Card, you represent and warrant to us that: (i) you are at least 18 years of age; (ii) the personal information that you have provided to us is true, correct, and complete; (iii) you have read this Agreement and agree to be bound by and comply with its terms.

Personalized Cards

If you make a Qualified Load to a Verified Card, we will send you a “Personalized Card,” which is a card with your name embossed on it. Once you activate your Personalized Card, you will no longer be able to use your Non-Personalized Card plastic. When you activate the Personalized Card, your balance and any associated direct deposit enrollment information is transferred automatically from the original card you received to the new Personalized Card. You will also be subject to the Personalized Card fee structure indicated in the Fee Schedule.

UNAUTHORIZED TRANSACTIONS

Contact in Event of Unauthorized Transfer

If you believe your Card has been lost or stolen, call or write Customer Service IMMEDIATELY at the contact information found at the beginning of this Agreement.

Your Liability for Unauthorized Transactions on your Verified Card

Tell us AT ONCE if you believe your Verified Card has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission. Calling Customer Service is the best way of keeping your possible losses down. You could lose all the money in your account. If you tell us within 2 business days after you learn of the loss or theft of your Card, you can lose no more than $50 if someone used your Verified Card without your permission. If you do NOT tell us within 2 business days after you learn of the loss or theft of your Card, and we can prove we could have stopped someone from using your Verified Card without your permission if you had told us, you could lose as much as $500.

Also, if your electronic history shows transfers that you did not make, including those made by your Verified Card or other means, tell us at once. If you do not tell us within 60 days after the earlier of the date you electronically accessed your account (if the unauthorized transfer could be viewed in your electronic history), or the date we sent the FIRST written history on which the unauthorized transfer appeared, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us in time. If a good reason (such as a long trip or a hospital stay) kept you from telling us, we will extend the time periods.

Your Card may have some additional protections against unauthorized use:

Visa Zero Liability policy covers U.S. issued cards only and does not apply to PIN transactions not processed by Visa, certain commercial card transactions, or unregistered cards. You must notify us promptly of any unauthorized use. For additional details visit www.visa.com/security.

Business Days

For purposes of these disclosures, our business days are Monday through Friday, excluding Federal holidays.

USING YOUR CARD

Accessing and Loading Funds

Each time you use your Card, you authorize us to reduce the value available on your Card by the amount of the transaction and applicable fees. If you use your Card number without presenting your Card (such as for an internet transaction, a mail order or a telephone purchase), the legal effect will be the same as if you used the Card itself. You may use your Card to purchase or lease goods or services wherever your Card is honored as long as you do not exceed the value available in your Card account.

You can use your Loyalty Card for general purchases and cash withdrawals in the United States. In addition to Loyalty Card functions, a Verified Card can be used to:

Load funds to your Card account;

Make foreign transactions.

You CANNOT use your Card to: (i) exchange your Card for its cash value; (ii) perform any illegal transactions; (iii) use the bank routing number and account number to make a debit transaction with any item processed as a check (these debits will be declined, and your payment will not be processed); or (iv) make business-related transactions. In addition, YOU ARE NOT PERMITTED TO EXCEED THE AVAILABLE AMOUNT IN YOUR CARD ACCOUNT THROUGH AN INDIVIDUAL TRANSACTION OR A SERIES OF TRANSACTIONS. Nevertheless, if a transaction exceeds the balance of the funds available in your Card account, you will remain fully liable to us for the amount of the transaction and agree to pay us promptly for the negative balance. If your Card has a negative balance, any deposits will be used to offset the negative balance. We may also use any deposit or balance on another Card you have with us to offset a negative balance on this Card.

Loading the Verified Card account: You may add funds to your Verified Card, called “loading,” by: (i) Automated Clearing House ("ACH") loads (e.g., direct deposit); (ii) Loading cash through one of our reload locations (a list is available at our Website or by calling our Phone Number) and (iii) Remote Deposit Capture through a third party service provider. See the Limits table below for limitations on amount and frequency for different load methods. Each load may be subject to a fee as set out in the Fee Schedule. If you arrange to have funds transferred directly to your Verified Card from a third party through an ACH load, you must enroll with the third party by providing the bank routing number and direct deposit account number that we provide you. The only federal payments that may be loaded to your Verified Card via ACH credit are federal payments for the benefit of the primary cardholder. If you have questions about this requirement, please call Customer Service. We will reject any loads that exceed the maximum balance allowed on your Card. There are also maximum load restrictions we may place on your Card when aggregated with any other Cards you have. You agree to present your Card and meet identification requirements to complete load transactions as may be required from time to time.

Split Transactions: If you do not have enough funds available in your Card account, you may be able to instruct the merchant to charge a part of the purchase to the Card and pay the remaining amount with another form of payment. These are called “split transactions.” Some merchants do not allow cardholders to split transactions or will only allow you to do a split transaction if you pay the remaining amount in cash.

Limits

Foreign Transactions

If you obtain your funds (or make a purchase) in a currency or country other than the currency or country in which your Card was issued ("Foreign Transaction"), the amount deducted from your funds will be converted by the network or card association that processes the transaction into an amount in the currency of your Card. The rate they choose is either: (i) selected from the range of rates available in wholesale currency markets (which may vary from the rate the association itself receives), or (ii) the government-mandated rate in effect for the applicable central processing date. The conversion rate selected by the network is independent of the Foreign Transaction fee that we charge as compensation for our services. You will be charged a Foreign Transaction fee in U.S. dollars equal to 3% on the total amount of the transaction. If the Foreign Transaction results in a credit due to a return, we will not refund any Foreign Transaction Fee that may have been charged on your original purchase.

CONFIDENTIALITY

We may disclose information to third parties about your Card account or the transactions you make:

- Where it is necessary for completing transactions;

- In order to verify the existence and condition of your Card account for a third party, such as merchant;

- In order to comply with government agency or court orders, or other legal reporting requirements;

- If you give us your written permission;

- To our employees, auditors, affiliates, service providers, or attorneys as needed; or

- As otherwise necessary to fulfill our obligations under this Agreement.

DOCUMENTATION

Receipts

You may be able to get a receipt at the time you make any transfer to or from your account using an ATM or point-of-sale terminals. You may need a receipt in order to verify a transaction with us or the merchant.

Account History and Balance

You may obtain information about your Card balance by calling Customer Service. This information, along with a 60-day history of account transactions, is also available online at the Website mentioned above.

TRANSACTIONS AND PREAUTHORIZED TRANSFERS

Right to stop payment and procedure for doing so if you have told us in advance to make regular payments out of your Verified Card account, you can stop any of these payments. Call or write to Customer Service with the contact information located at the beginning of this Agreement in time for us to receive your request three business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within 14 days after you call.

Notice of varying amounts

If these regular payments vary in amount, the person you are paying should tell you, at least 10 days before each payment, when it will be made and how much it will be.

Liability for failure to stop payment of preauthorized transfer

If you order us to stop one of these payments three business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

Our liability for failure to complete transactions

If we do not complete a transaction to or from your Card account on time or in the correct amount according to our Agreement with you, we will be liable for your losses and damages proximately caused by us. However, there are some exceptions. We will not be liable, for instance:

- If, through no fault of ours, you do not have enough funds available in your Card account to complete the transaction;

- If a merchant refuses to accept your Card;

- If an ATM where you are making a cash withdrawal does not have enough cash;

- If an electronic terminal where you are making a transaction does not operate properly and you knew about the problem when you initiated the transaction;

- If access to your Card has been blocked after you reported your Card or PIN lost or stolen;

- If there is a hold or your funds are subject to legal process or other encumbrance restricting their use;

- If we have reason to believe the requested transaction is unauthorized;

- If circumstances beyond our control (such as fire, flood or computer or communication failure) prevent the completion of the transaction, despite reasonable precautions that we have taken; or

- For any other exception stated in our Agreement with you.

Preauthorized Credits

If you have arranged to have direct deposits made to your Verified Card account at least once every 60 days from the same person or company, the person or company making the deposit should tell you every time they send us the money. You can call Customer Service to find out whether or not the deposit has been made.

Authorization Holds

With certain types of purchases (such as those made at restaurants, hotels, or similar purchases), your Card may be “preauthorized” for an amount greater than the transaction amount to cover gratuity or incidental expenses. Any preauthorization amount will place a “hold” on your available funds until the merchant sends us the final payment amount of your purchase. Once the final payment amount is received, the preauthorization amount on hold will be removed. During this time, you will not have access to preauthorized amounts. If you authorize a transaction and then fail to make a purchase of that item as planned, the approval may result in a hold for that amount of funds.

IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR VERIFIED CARD

Call or write Customer service at the Phone Number, Address, or Website mentioned above as soon as you can, if you think an error has occurred in your Verified Card account. We must allow you to report an error until 60 days after the earlier of the date you electronically access your account, if the error could be viewed in your electronic history, or the date we sent the FIRST written history on which the error appeared. In any case, we may limit our investigation of any alleged error that you do not report to us within 120 days of the posted transaction. You may request a written history of your transactions at any time by calling or writing us Customer Service. You will need to tell us:

- Your name and prepaid account or Card number.

- Why you believe there is an error, and the dollar amount involved.

- Approximately when the error took place.

- If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days. We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, and your account is verified with us, we will credit your account within 10 business days for the amount you think is in error, so that you will have the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

- For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to credit your account for the amount you think is in error.

- We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation. If you need more information about our error-resolution procedures, call Customer Service or visit our Website.

ADDITIONAL TERMS OF THE AGREEMENT

Personal Identification Number (“PIN”)

You will receive a Personalized Identification Number ("PIN") by calling Customer Service at the Phone Number above. You should not write or keep your PIN with your Card. Never share your PIN with anyone and do not enter your PIN into any terminal that appears to be modified or suspicious. If you believe that anyone has gained unauthorized access to your PIN, you should contact Customer Service immediately.

Returns and Refunds

If you are entitled to a refund for any reason for goods or services obtained with your Card, the return and refund will be handled by the merchant. If the merchant credits your Card, the credit may not be immediately available. While merchant refunds post as soon as they are received, please note that we have no control over when a merchant sends a credit transaction and the refund may not be available for a number of days after the date the refund transaction occurs. We are not responsible for the quality, safety, legality, or any other aspect of any goods or services you purchase with your Card.

Card Replacement and Expiration

If you need to replace your Card for any reason, please contact Customer Service. See Fee Schedule for applicable fees. Please note that your Card has a “Valid Thru” date on the front of the Card. You may not use the Card after the “Valid Thru” date on the front of your Card. However, even if the “Valid Thru” date has passed, the available funds on your Card do not expire. You will not be charged a fee for replacement cards that we send due to expiration of the Card.

Authorized Users

If you allow another person to use the Card, you will be responsible under this Agreement for all transactions made by that person, regardless of whether you intended to be responsible for all of them, as well as all associated fees and charges, even if any of those transactions, fees or charges caused your balance to go negative.

Communications

You agree that we may monitor and record any calls or other communications between us and you. You also agree that we or our service providers may contact you with any contact information you provide to us, including cellular and wireless phone numbers, landline numbers, and email addresses. You also agree that we or our service providers may contact you by using an automated dialing or email system, by text, or artificial or recorded voice. You agree to pay any service charges assessed by your plan provider for communications we send or make to you or that you send or make to us.

LEGAL NOTICES

English Language Controls

Translations of this Agreement that may have been provided are for your convenience only and may not accurately reflect the original English meaning. The meanings of terms, conditions, and representations herein are subject to definitions and interpretations in the English language.

Account Closure

You may close your Card at any time by contacting Customer Service. Your request for Card closure will not affect any of our rights or your obligations arising under this Agreement prior to the request. Should your Card account be closed, we will issue you a credit for any unpaid balances, subject to fees as disclosed in the Fee Schedule. We reserve the right to close your Card account should you complete or attempt to complete any of the prohibited actions in this Agreement.

Assignability

You may not assign or transfer your Card or your obligations under this Agreement. We may, however, transfer or assign our rights under this Agreement, including any balances in your Card account. If we assign our rights, you will get a notification from us.

Legal Process

Regardless of where or how we are served, we will comply with any state or federal legal process, including, without limitation, any writ of attachment, adverse claim, execution, garnishment, tax levy, restraining order, subpoena or warrant we believe to be valid relating to you or your Card. You agree that we will honor legal process that is served personally, by mail, or by facsimile transmission at any of our offices (including locations other than where the funds, records or property sought is held), even if the law requires personal delivery at the office where your Card account records are maintained. You agree that we will have no liability to you for honoring any such legal process. You also agree that we will have no obligation to assert on your behalf any applicable exemptions to execution or attachment under any applicable state or federal law. We will enforce a right of security interest against any of your Card accounts in order to reimburse us for our fees and expenses, including attorneys’ fees, court costs and expenses, in complying with legal process. We may refuse to permit withdrawals or transfers from your account until such legal process is satisfied or dismissed, even if such action results in insufficient funds to satisfy an obligation you may have incurred. We may deduct such expenses from your Card account or any other account you may have with us without prior notice to you, or we may bill you directly for such expenses and fees. You agree to release and indemnify, defend and hold us harmless from all actions, claims, liabilities, losses, costs and damages including, without limitation, attorneys’ fees, associated with our compliance with any legal process. When we receive an order instructing us to restrict access to funds in a Card account, we may remove the funds from the account and maintain them separately.

Other Terms

You will be notified of any change to this Agreement in the manner required by applicable law prior to the effective date of the change. However, if the change is made for security purposes, we can implement such change without prior notice. We do not waive our rights by delaying or failing to exercise them at any time (for example, assessing a fee less than described, or not all, for any reason does not waive our right to begin charging the fee as set forth in this Agreement without notice). If any provision of this Agreement is determined to be invalid or unenforceable under any rule, law, or regulation of any governmental agency, local, state, or federal, the validity or enforceability of any other provision of this Agreement will not be affected. This Agreement will be governed by the law of the state of South Dakota except to the extent governed by federal law. Should your Card have a remaining balance after a certain period of inactivity, we may be required to remit the remaining funds to the appropriate state agency.

JURY TRIAL WAIVER

YOU AND WE ACKNOWLEDGE THAT THE RIGHT TO TRIAL BY JURY IS A CONSTITUTIONAL RIGHT BUT MAY BE WAIVED IN CERTAIN CIRCUMSTANCES. TO THE EXTENT PERMITTED BY LAW, YOU AND WE KNOWINGLY AND VOLUNTARILY WAIVE ANY RIGHT TO TRIAL BY JURY IN THE EVENT OF LITIGATION ARISING OUT OF OR RELATED TO THIS AGREEMENT. THIS JURY TRIAL WAIVER SHALL NOT AFFECT OR BE INTERPRETED AS MODIFYING IN ANY FASHION THE ARBITRATION CLAUSE SET FORTH IN THE FOLLOWING SECTION, WHICH CONTAINS ITS OWN JURY TRIAL WAIVER.

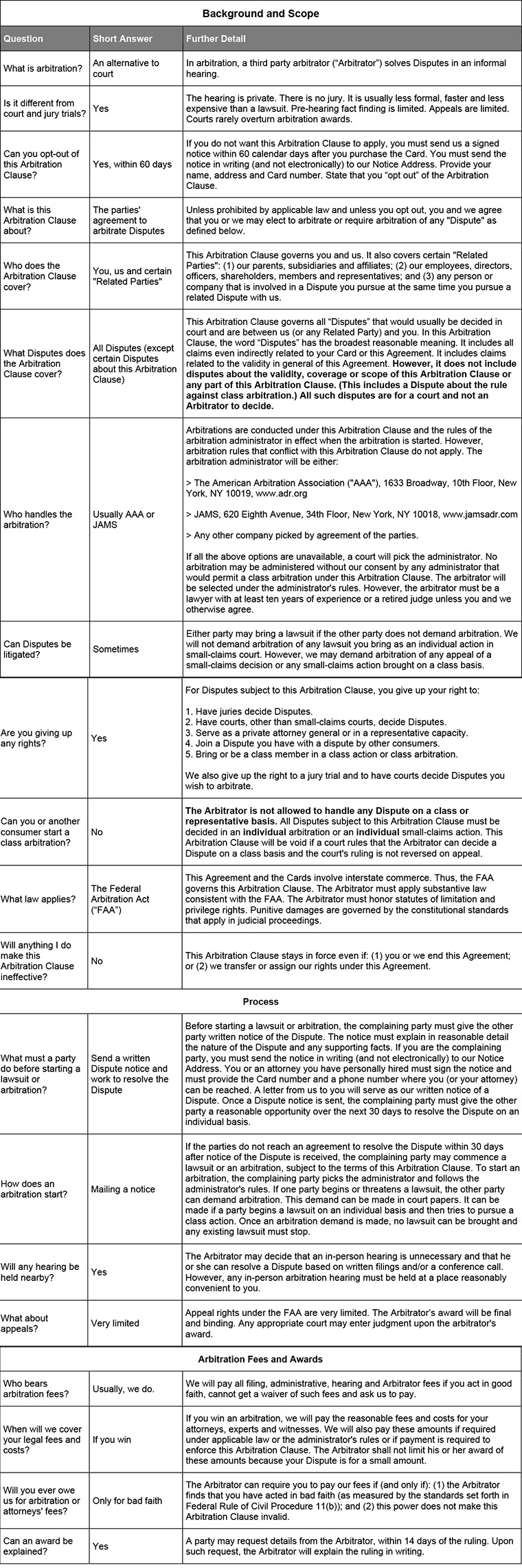

ARBITRATION CLAUSE

We have put this Arbitration Clause in question and answer form to make it easier to follow. However, this Arbitration Clause is part of this Agreement and is legally binding. For purposes of this section, our “Notice Address” is: Pathward, Attn: Customer Service, 5501 S Broadband Ln, Sioux Falls, SD 57108.

Prepaid card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.

E1 Visa Prepaid Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask you for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents.

1Available if a tax refund will be and/or has been deposited to the card account.

2Standard data and messaging rates may apply.

3Although this service is offered for no cost, third party fees may apply.

4Faster access to funds is based on comparison of traditional banking policies and deposit of paper checks versus deposits made electronically and the additional methods available to access funds via a Card as opposed to a paper check.